9 min read

Business Valuation Trends for 2026: Get Ahead of What Buyers Want

If you're planning to sell your business in 2026, start with a tougher question: What will buyers actually pay, and why?

Discover the true value of your business in just a few minutes. Start your confidential valuation today.

%20copy%202.png?width=500&height=208&name=group_jan_30_25_4000px%20(1)%20copy%202.png)

At Sunbelt Atlanta our team is made up of seasoned professionals with more than 90 years of collective experience selling companies. Our backgrounds and industry experience are as varied as the companies we represent. Some come from main-street, some from Wall Street. Collectively, we have closed hundreds of transactions and the companies we have sold range in size from $100,000 to $50,000,000 in revenue and span all industries.

8 min read

Doreen Morgan

:

Feb 6, 2025 6:25:30 PM

Doreen Morgan

:

Feb 6, 2025 6:25:30 PM

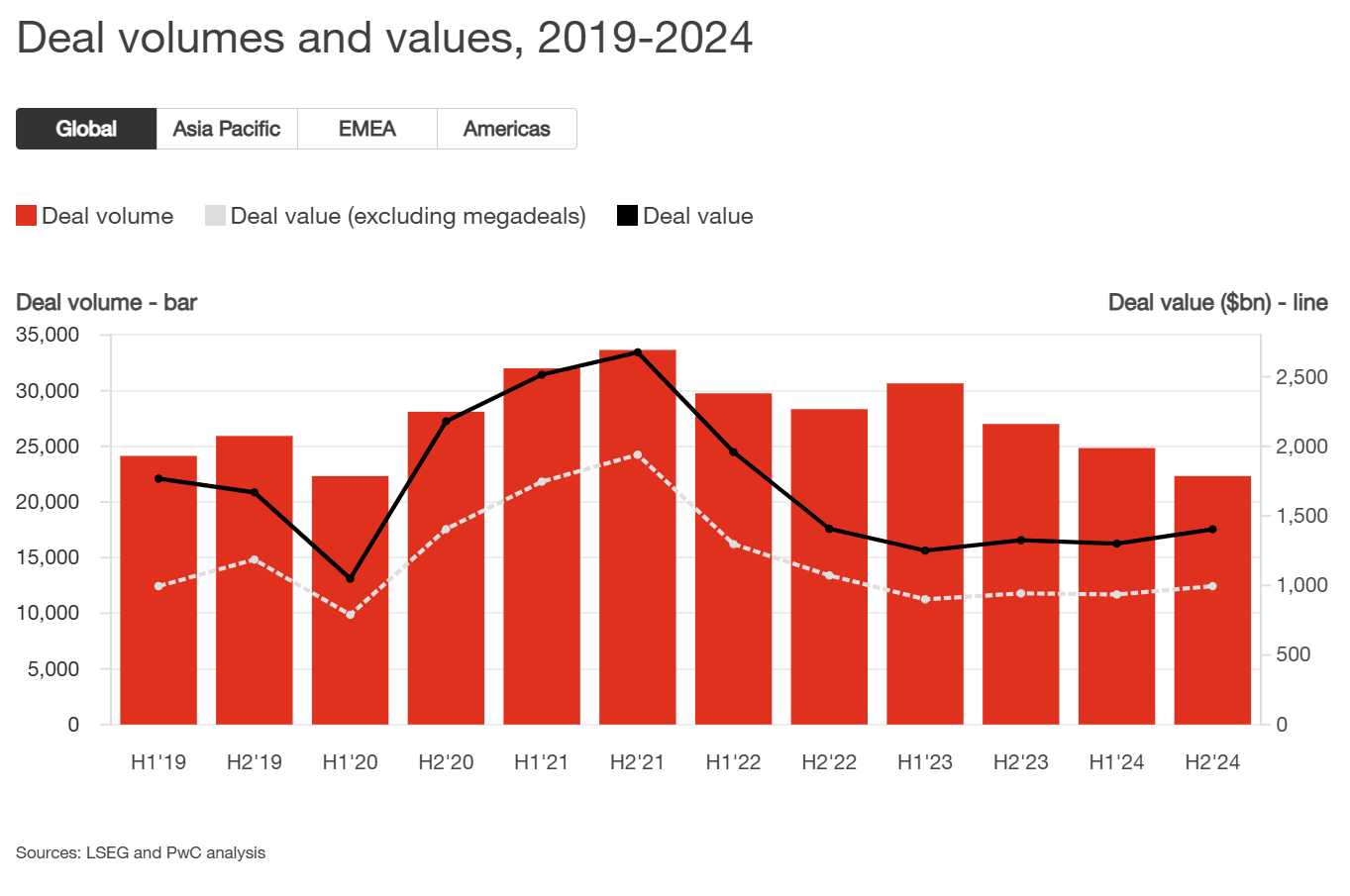

After a period of fits and starts, the landscape for mergers and acquisitions appears poised for renewed momentum in 2025. Recent data points—from increasing large-deal volumes to evolving macroeconomic conditions—offer optimism for business owners considering a sale or valuation assessment. Yet, amid the encouraging signs, the market continues to flash mixed signals. Understanding these nuanced shifts is critical for those aiming to capture optimal value.

High-value deals exceeding $1 billion in size increased notably in 2024, up by 17% according to recent market data. Although these transactions make up only about 1% of annual global deal volume, they often signal confidence from major acquirers—and, by extension, the broader market. When marquee deals make headlines, midsized and smaller companies tend to feel a corresponding bump in their own valuations, as potential buyers don’t want to miss out on transformative growth opportunities.

Conversely, the volume of smaller and mid-market deals fell by approximately 18% in 2024. This divergence underscores the importance of solid financial fundamentals and a compelling growth narrative. Owners who can demonstrate a well-differentiated business model, consistent revenue streams, and clear potential for expansion will likely attract stronger offers—even when overall activity in the lower segments lags.

In late 2024, central banks across various countries implemented reductions in their short-term interest rates. For many buyers, these cuts effectively lowered the cost of obtaining financing, which helped spur a noticeable uptick in acquisition activity. When interest rates decline, prospective buyers can borrow money at a reduced expense, leaving them with more flexibility to pursue deals—potentially driving higher valuations for businesses that are seen as strong targets.

However, a critical development in 2025 is the simultaneous rise in long-term interest rates. While short-term rates are still low, the increase in longer-term yields means banks and alternative lenders may become more cautious about lending. This caution can tighten the availability of favorable loan terms, especially for businesses that have inconsistent cash flows or operate in more volatile sectors. In practical terms, if you’re running a solid company with healthy profit margins, you’re likely to remain attractive to buyers who can still secure financing at reasonable rates. But if your business is more susceptible to economic shifts, higher long-term borrowing costs might dampen enthusiasm among certain buyer groups or at least prompt them to negotiate a lower multiple.

Alongside these shifts in interest rates, private credit funds—now managing upwards of $1.7 trillion—have stepped in to fill any gaps in traditional lending. Private credit providers, such as direct lenders and debt funds, often offer flexible financing structures that banks might shy away from. These structures can be especially valuable when a buyer and seller have a difference in opinion about a company’s value; creative loan terms can bridge that valuation gap.

For business owners, the growing private credit market can be both an opportunity and a challenge. If your company is profitable and well-managed, the competition among lenders vying to finance deals could drive up the price a buyer is willing to pay. Buyers can secure larger loans or more favorable terms, and that increased financial capacity can translate into higher offer prices for you. On the flip side, the surge in private credit has also led to more restructurings for businesses that take on too much debt. While that may not apply to a stable, thriving company, it’s important to recognize that private credit’s rise brings a new wave of lending practices—and not all of them will be a perfect fit for every seller or buyer.

In short, understanding how interest rates and capital flows are evolving is crucial if you’re planning to sell. The interplay between short-term cuts, rising long-term yields, and the private credit boom shapes who can afford to buy your company, how they’ll structure the deal, and ultimately what price they’re willing to offer.

In early 2025, the U.S. administration implemented significant tariff increases, imposing a 25% levy on imports from Canada and Mexico, and a 10% tariff on goods from China. These measures are part of the "America First Trade Policy," aiming to bolster domestic industries and address trade imbalances.

For business owners considering a sale, these policy shifts can have varied impacts on valuations. Companies heavily reliant on imported materials from the affected countries may face increased costs, potentially squeezing profit margins. This could make such businesses less attractive to potential buyers. Conversely, firms that source materials domestically or have diversified supply chains might find themselves in a more favorable position, as the heightened tariffs could reduce competition from imported goods.

Additionally, industries that may benefit from potential deregulation, such as telecommunications, energy, and healthcare, could see enhanced valuations due to a more favorable operating environment. However, the overall impact of these policy changes will depend on how businesses adapt to the evolving trade landscape and manage associated risks.

In short, while the administration's policy shifts aim to strengthen domestic industries, they introduce complexities that can significantly influence business valuations. Owners should carefully assess how these changes affect their operations and market positioning to make informed decisions about potential exits.

Over the past year, US stock markets have traded at notably higher valuations compared to their international counterparts. For instance, the S&P 500’s forward price-to-earnings (P/E) ratio has hovered around 22.87, while many global markets average closer to 13.67. Although these numbers might seem abstract, they effectively signal that investors are willing to pay more for shares of US-based companies relative to similar businesses abroad.

For a US business owner contemplating an exit, these higher valuations can be good news—but there are nuances to consider. When a publicly traded buyer has “overvalued” or richly priced shares, they may use their stock as currency in acquisitions. Essentially, if a buyer’s own shares are trading at a premium, the buyer can offer you stock in the acquiring company instead of (or in addition to) cash. This can drive up the total price paid for your business because they have more “value” to work with.

At the same time, US companies looking to expand globally might view foreign businesses as more affordable. For example, an American manufacturing firm—trading at a high multiple—could look to purchase a European competitor at a comparatively lower valuation. While this might initially sound like a separate issue, it still affects US owners. If too many buyers decide to shop overseas for “bargains,” that could reduce the competitive tension for deals at home, potentially putting downward pressure on certain US valuations.

Another factor is the relative strength of the US dollar. A strong dollar makes it more attractive for American buyers to acquire assets abroad since their money goes further in foreign currencies. Conversely, foreign buyers might have to pay a premium when purchasing US companies if their home currency is weaker. As a business owner, understanding these currency dynamics can help you gauge whether foreign buyers are likely to be part of your prospective buyer pool and how that competition (or lack thereof) might influence your asking price.

In short, high US valuations can be a double-edged sword. On one hand, well-positioned companies in the States can often command impressive multiples if the buyer can leverage strong stock prices. On the other hand, global investors may look elsewhere if valuations seem too steep, affecting the overall competitive landscape. Staying aware of how these broader market forces work—and how they impact both domestic and international buyers—can help you time your exit more strategically and negotiate from a position of strength.

One of the most influential forces in today’s market is the rapid adoption of artificial intelligence. Organizations of all sizes are searching for ways to use AI to streamline operations, enhance customer experiences, or create novel products and services. Companies with tangible AI capabilities often enjoy a premium in their valuation, and businesses that have laid the groundwork for digital transformation are increasingly attractive to both strategic and financial buyers.

The immense capital flowing into data centers, power generation, and digital infrastructure—areas that are critical to AI’s growth—can also affect the traditional M&A market by drawing funds into “build” strategies rather than “buy.” Still, the opportunities to acquire AI-centric firms remain strong, especially when it can accelerate a buyer’s modernization efforts or fill a critical technological gap.

Many business owners who delayed their exits due to global uncertainties are now preparing to bring their companies to market. While this influx may increase the overall supply of businesses for sale, it also elevates the importance of differentiation and timing, particularly in sectors where quality targets are in high demand. Owners who used the recent downtime to improve financial documentation, refine leadership teams, and stabilize operations stand to command the highest valuations. This preparation can include streamlining costs, enhancing product or service offerings, and documenting consistent revenue and profit growth—factors that buyers are eager to see.

The generational transition fueling much of this activity, often referred to as the “silver tsunami,” involves a large cohort of baby boomer entrepreneurs who are looking to retire or move on after years of running successful ventures. Studies have long projected a surge in retirements as this demographic reaches a tipping point, and the pent-up demand created by past economic uncertainties is finally starting to materialize. Consequently, the market may see heightened deal flow in certain industries—manufacturing, healthcare, logistics, and professional services, for instance—where older business owners are prominent.

However, prospective sellers must remain vigilant about potential macroeconomic and policy headwinds. Shifts in interest rates, changes in trade or tax policy, and ongoing geopolitical tensions can all affect both the appetite of prospective buyers and the multiples at which deals get done. These broader forces can narrow or widen the valuation gap between buyer and seller, impacting whether a deal ultimately closes. Even amid a strong seller’s market, it’s crucial for business owners to regularly assess how external dynamics—such as labor availability, supply chain resiliency, and consumer confidence—could affect their company’s risk profile and bottom line.

Taken together, the silver tsunami can create a more robust market for private company sales, but it also raises the bar for what constitutes a truly “attractive” listing. Those who’ve proactively enhanced their businesses, demonstrated consistent performance, and prepared themselves for rigorous buyer scrutiny can often command premium pricing. By contrast, those who enter the fray with unresolved operational inefficiencies or unclear financials may find themselves overshadowed by the best-in-class opportunities that buyers are actively pursuing.

One interesting dynamic in 2025 is the contrast between splashy megadeals and the more subdued mid-market activity. Larger companies and substantial private equity funds continue to pursue high-profile transactions, benefiting from robust balance sheets and favorable financing. In the mid-market, however, buyers and sellers must often deploy creative deal mechanisms—such as earnouts, seller financing, or minority equity rollovers—to align on valuations and manage risk. Even though the overall M&A climate is improving, these innovative structures can be crucial to closing transactions when capital costs are unpredictable and valuations differ significantly.

As dealmaking momentum builds, it’s crucial for owners to keep an eye on the broader forces that can shape their company’s valuation. Whether you plan to sell in the near future or simply want to stay competitive in a rapidly changing environment, attention to the following factors can be a difference-maker in achieving a successful outcome:

Valuation Benchmarks

Comparable sales within your sector can serve as an early warning system for how the market is shifting. Larger deals in your industry might set new valuation norms—either raising the bar or resetting expectations. Monitoring these benchmarks helps you calibrate your business’s position and ensure you remain realistic about possible deal multiples.

Regulatory and Political Uncertainty

Elections, tariff changes, and policy overhauls can recalibrate buyer sentiment almost overnight. Adjustments to trade agreements or tax laws often trickle down to operational costs, making it imperative for you to stay informed and agile. A sudden regulatory shift could either boost your company’s attractiveness or inject new complexities into negotiations.

Interest Rate Movements

While short-term rates have been cut in many markets, long-term yields have started to edge upward. This dynamic can influence the cost of capital for leveraged deals, potentially lowering the multiples buyers are willing to pay. Keeping tabs on interest rate trends helps you anticipate changes in the financing environment that may affect your asking price or overall deal structure.

AI Readiness

AI has become a transformative force across industries—from manufacturing and healthcare to logistics and finance. Prospective acquirers place increasing value on businesses that already leverage data analytics, machine learning, or other advanced technologies to differentiate themselves. Even smaller steps toward digital transformation can enhance your company’s perceived worth.

Market Timing

2025 is expected to bring steadier M&A momentum, but it will favor sellers who have prepared diligently. Clean, transparent financials and a compelling growth narrative can spark competitive bidding. If you are still addressing operational inefficiencies or unresolved leadership transitions, accelerate those efforts now to position yourself for a higher valuation when you do enter the market.

Despite lingering uncertainties, 2025 is shaping up to be a critical year for business valuations. The blend of renewed optimism around large-scale transactions, a surge of private capital, shifting policies under the new U.S. administration, and the rise of AI-driven transformations all present a wealth of opportunities for well-prepared sellers. With the right combination of preparedness and agility, a business can capitalize on this moment—potentially achieving a valuation that would have been out of reach in less dynamic conditions. By keeping a finger on the pulse of evolving trends and focusing on foundational value drivers, owners can set the stage for a favorable outcome in what could be one of the most compelling M&A periods in recent memory.

9 min read

If you're planning to sell your business in 2026, start with a tougher question: What will buyers actually pay, and why?

17 min read

In America, Covid-19 first began to impact the business world in January 2020. By March 2020 its impact was in full swing as lockdowns began and the...

4 min read

Selling your company can feel daunting, but there is a proven model for increasing business value and successfully closing deals. The goal here is to...